U.S. Elections and the Financial Markets

By Dave Zellner

Chief Investment Officer

October 28, 2020

When we launched this blog platform earlier this year, I felt it would be a great place to respond to questions we hear from our stakeholders and to share our thoughts on current events.

Of course, one question we are hearing quite frequently right now directly relates to one of the biggest global events of the year: the upcoming U.S. elections. Naturally, our participants and institutional investors want to know what impact the elections may have on financial markets. I shared some of these thoughts in our recent quarterly investment webinar, but I would like to expand on them here.

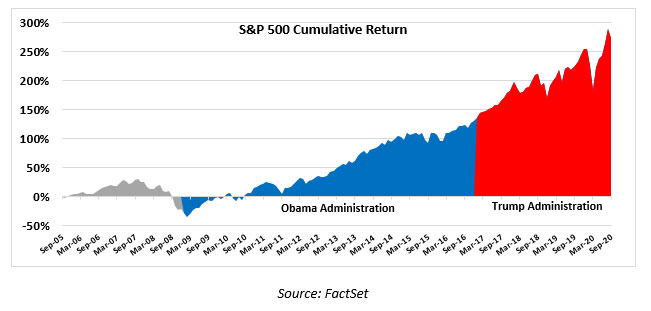

I think J.P. Morgan Chief Global Strategist David Kelly best addressed the election question in his recent webinar. David made two particularly salient points, in my view. The first is that investors should not let their politics determine their investment strategy. David noted that many Republicans thought the stock market would go down under President Obama, and many Democrats felt the same about the Trump administration. Both were wrong:

Dr. Kelly also noted that, since World War II, the U.S. economy has achieved both economic growth and strong stock market returns under a variety of political scenarios, including one-party rule by both major parties as well as divided governments. I agree with these assessments, and the facts bear out this sentiment.

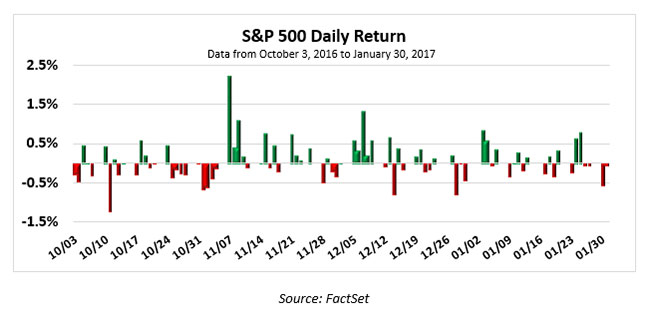

It does seem likely that major events like elections can cause short-term volatility. We know the market does not like uncertainty or surprises. For example, before and after Donald Trump’s relatively unexpected victory played out in 2016, we witnessed some whipsawing in stocks:

As it pertains to this year’s elections, I have seen some commentators posit that the markets might experience turbulence should the winner of the presidential race remain uncertain after election night, especially if determining the outcome drags on for weeks or possibly months. Again, the market does not like uncertainty.

As we have through other times of uncertainty, Wespath will maintain its disciplined approach to investing through this election cycle. Our asset managers continue to consider a variety of factors in their stewardship of our assets – elections and future political environments included.

Our asset managers speak about building resilient, diversified portfolios designed to capture opportunities while weathering the many uncertainties, including elections, faced by investors. The same holds true for Wespath’s overarching investment program.

The funds we offer are positioned for the long-term. We are not making changes based on the various possible outcomes of the election or the uncertainties that come with it.