Reflections on the GameStop Mania from a Long-Term Investor

By Joe Halwax

Managing Director, Institutional Investment Services

January 29, 2021

In recent days, there has been market mania centered around the company GameStop (GME) and a few other stocks trending on the internet. We have seen a truly surreal story play out in real time on business TV and social media.

The exact details are probably best told by the reporters covering the story. I recommend these recaps from The Wall Street Journal and Yahoo Finance. From the Wespath perspective, I am more interested in answering the question: How does this impact a long-term investor?

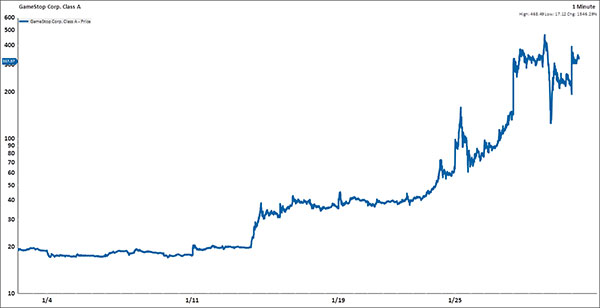

GME Stock Performance (1/3/21 – 1/28/21)

Source: FactSet. Logarithmic Scale.

The short answer is events like the GameStop mania rarely have a significant impact on our investment program. We are invested for the long-term – guided by our Investment Philosophy and Beliefs, which reflect our macroeconomic view and expectations regarding the drivers of future economic growth. Of course, we actively monitor global markets and our external asset managers on a daily basis, but we are not tactical traders, nor market timers.

What does this mean? Well, by "not tactical," I mean we are not actively moving in and out of certain markets or equities in search of a short-term advantage. As part of our disciplined process, we also do not engage in market timing, or attempting to time market fluctuations based on short-term factors. What’s more, the moves of any one company tend to have a minimal impact on our overall investments; we hold over 8,600 securities in our flagship balanced strategy, for example.

So when might a single stock’s fluctuations be concerning to a diversified, long-term investor? In my view, it is when that event is indicative of a larger issue that could have a broader impact. In the context of the GameStop story, there are three points worth discussing: market structure/regulations, a loss of confidence in public markets and the rise of populism.

When we consider the evolution of investment-related social media – including "FinTwit", TikTok traders and Reddit's "WallStreetBets" – it stands to reason that one outcome of the GameStop volatility may be more regulation of these platforms.

While this has been framed by the media as a "David vs. Goliath" – the Reddit traders taking on Wall Street, so to speak – it is easy to see how large institutional investors could use these same platforms to produce social media posts that may manipulate retail traders. In other words, Goliath might be motivated to benefit from the same online tools that caused it pain in recent weeks.

Now, could increased regulation of social media companies impact us as long-term investors? That is unclear, for now. The answer may well be "no," but it is something we will closely monitor as this situation continues to unfold.

Another consideration is the effect this may have on overall trust in the financial system. In public markets there are always pockets of speculation, but the events of the past week enforce an idea that markets have a casino-like quality. This can certainly erode confidence in U.S. public markets. While elements of this story trigger empathy for the "little guy," the longer-term damage to the credibility of the U.S. financial system is a real risk.

The final issue observed in the GameStop mania is its tie to populism. This event has been likened to the "Occupy Wall Street" movements, but instead of protesting outside the exchange, real dollars are at stake. Previous manias – from tulips in 1637 to the dot-com bubble in the late 1990s – have been driven by greed. While this event has elements of greed, more notably it has a high degree of anger, driven by a sense of revenge on a system the Reddit traders believe to be unfair or unjust.

This evokes thoughts of our Sustainable Economy Framework, which describes a vision of a more sustainable economy that empowers long-term prosperity for all, social cohesion and environmental health. We are definitely conscious of – and actively working with fellow sustainable investors on – many of the inequalities evident around the world. This includes executive compensation, board diversity, human capital, corporate environmental and social impacts, and many more issues relevant to the creation of a sustainable economy.

The GameStop mania has been an incredible event to watch unfold. The emotions on display will be remembered for years to come. While we’ve noted that this type of stock move does not directly change our long-term philosophy or investment process, we are students of the market and will continue to closely watch for any broader impacts. We will also continue to focus on addressing global inequalities and working towards a better world.