Paris Agreement Officially in Effect: What It Means for Investors

By Jake Barnett

Manager, Sustainable Investment Services

February 26, 2021

It's official: The United States re-entered the Paris Agreement last Friday, marking another important shift in global climate policy. The U.S. will now begin pursuing the goals of the landmark agreement—just one month after President Biden signed an executive order stating the world's largest economy's intent to rejoin the accord.

The fundamental mission of the Paris Agreement is limiting the increase in global average temperature to well below 2 degrees Celsius above pre-industrial levels. Paris endorsers have also agreed to pursue efforts to limit that temperature rise to 1.5 degrees. The hope is that limiting temperature increases to this level will help reduce the risks of climate change.

In practice, much of the work toward achieving the Paris goals will depend on each endorser's nationally determined contributions (NDCs). NDCs are essentially country-specific action plans that outline emissions reduction targets for a particular nation over the next five to ten years.

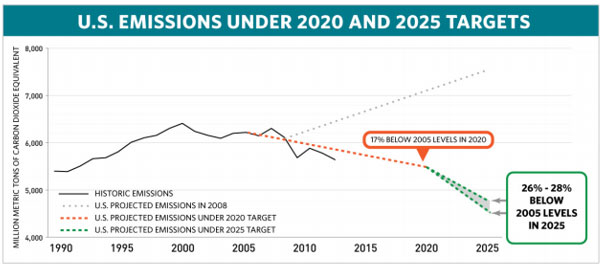

So far, more than 180 countries have submitted initial NDCs – including the United States, consistent with its original endorsement of the Paris Agreement in 2016. At the time, the U.S. aspired to reduce greenhouse gas emissions by 26% to 28% from their 2005 level by 2025 and pledged $3 billion in funding for global climate action.

Source: UN NDC Registry

The Paris Agreement asks that countries update their NDCs a regularly and improve them over time—the Biden Administration is working to craft new NDCs to guide U.S. emissions reductions over the next decade. The administration expects to release NDCs for the U.S. on April 22 at a UN Climate Leaders' Summit coinciding with Earth Day.

We expect many other countries will update their NDCs ahead of this year's 26th UN Climate Change Conference of the Parties (COP26) in November. This conference serves as the decision-making body for the UN Framework Convention on Climate Change and provides a platform for heads of state, climate experts and policy negotiators to collaborate on next steps. UN Secretary General António Guterres has asked that global leaders pursue more ambitious targets ahead of COP26, setting the stage for 2021 to be a pivotal year for climate action.

Along with updated commitments from governments, it is also worth noting that private sector commitments to carbon neutrality are on the rise. In fact, a recent study found that over 1,100 businesses are now targeting net-zero emissions by 2050, representing a tripling of commitments between fall 2019 and 2020.

As long-term investors, we continue to monitor heightened climate ambitions from both the public and private sectors. If U.S. regulators and corporations pursue a significant reduction of emissions throughout the economy in the next several years, it will likely require fundamental changes to how the economy operates. These changes have investment implications – both risks and opportunities – and we have a fiduciary responsibility to consider their impacts on our portfolios.

It is also clear that governments must invest considerably in climate-related technology, infrastructure and financial solutions to achieve the Paris Agreement's goals. This spending will have direct investment implications, resulting in "winners and losers" in the private sector.

Those of you familiar with Wespath's investment approach may find some of these concepts quite familiar. Indeed, we have long used phrases like "winners and losers" and "risks and opportunities" to describe our approach to climate change. In fact, it is all explicitly outlined in our Low-Carbon Transition Investment Belief:

"A global transition to a low-carbon economy is underway driven by the world's assessment of environmental risks. We believe public policies, emerging technologies and physical impacts associated with concerns about climate change are creating winners and losers across companies, industries and countries, impacting investment returns. As prudent fiduciaries, we must assess these global risks and opportunities in the management of our funds."

The Paris Agreement is significant because it is a global commitment to a low-carbon transition. Even more encouraging, we are now seeing many of the world's leading economies commit to full carbon neutrality. In fact, with the U.S. rejoining Paris and President Biden pledging to move toward net-zero emissions by 2050, nine of the world's 10 largest economies have stated ambitions to become carbon neutral.

The time of bold, international climate action is very much here. We are pleased to have beliefs and practices ready to guide our approach to this important shift.