By Ryan McQueeney

Analyst, Sustainable Investment Stewardship

November 22, 2021

On the heels of “Finance Day” at COP26, investors from around the world are feeling a heightened sense of urgency as political leaders, climate experts and other key stakeholders call on the financial community to step up their climate ambitions.

These stakeholders are asking investors to explicitly commit to the actions that they will take to actively support the transition to a net-zero future. These commitments can include investment stewardship activities, such as shareholder engagement focused on urging companies to adopt net-zero-aligned policies, as well as making changes to investment portfolios to reflect the risks and opportunities resulting from the economic changes caused by climate change.

Wespath has a long history of both climate stewardship and integrating climate change considerations into its investment process. We have clearly stated our perspective in our “Low-Carbon Transition” Investment Belief:

A global transition to a low-carbon economy is underway driven by the world’s assessment of environmental risks. We believe public policies, emerging technologies and physical impacts associated with concerns about climate change are creating winners and losers across companies, industries and countries, impacting investment returns. As prudent fiduciaries, we must assess these global risks and opportunities in the management of our funds.

Today, we’ll focus on the investment integration process, as this marks the three-year anniversary of the launch of the Wespath | BlackRock “Transition Ready” investment framework! Over the last three years, this innovative strategy has delivered competitive investment returns and strong environmental performance; we dig into how it all works below.

What is the Transition Ready framework?

At its core, the Transition Ready framework seeks to improve long-term investment performance compared to traditional benchmarks by identifying “Transition Ready” companies—those that are well prepared for the economic transition attributable to climate change.

More specifically, the Transition Ready framework is what we call an “enhanced passive” strategy, which is similar to traditional passive investment strategies that track common indexes or benchmarks. You’ve likely heard of passive strategies that seek to match the performance of popular indexes like the S&P 500 or Russell 3000. These types of strategies are typically lower cost compared to actively managed strategies, in which an asset manager attempts to hold securities with the goal of significantly outperforming a benchmark index.

In an active strategy, a manager might have high conviction in the transition to net-zero and could factor its beliefs into its active investment decisions. But passively managed strategies are agnostic to the systemic risks of, and economic changes caused by, climate change; they simply reflect the market’s pricing of their underlying securities. If one believes—as Wespath does—that the market isn’t properly assessing the risks and opportunities associated with the world’s response to climate change, then traditional passively managed strategies will hold securities of companies insufficiently prepared for the transition.

Recognizing this inherent flaw with traditional passive strategies, the enhanced passive Transition Ready strategies were born! This approach seeks to deliver long-term excess returns compared to standard investment indexes by overweighting companies best positioned for the low-carbon transition and underweighting companies lagging in adjusting their business models for the transition.

What does the framework consider?

The framework assesses companies based on their core business involvement and management of natural resources. This assessment considers five core components:

The strategy evaluates these components using a variety of sustainability data, industry materiality and BlackRock’s proprietary process. It scores each company on each individual component, which is then combined to create an overall “Transition Readiness” assessment. The framework then suggests overweighting1 companies with stronger assessments and underweighting those that are less prepared for the transition.

In addition, the Transition Ready strategy maintains sector neutrality, meaning that it intentionally avoids overweighting or underweighting an industry sector relative to its weighting in the performance benchmark. More information about the development of the Transition Ready framework and its process for evaluating companies is available here.

How have the Transition Ready strategies performed?

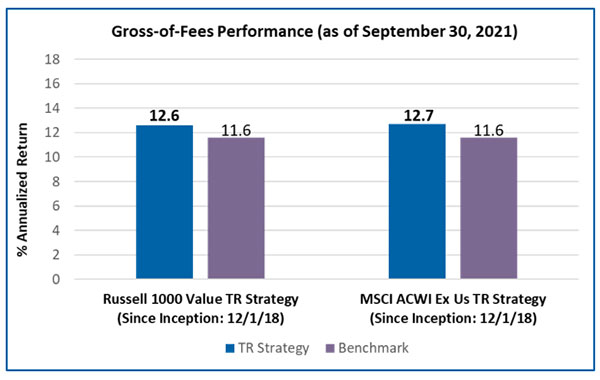

At the 2018 launch of the Transition Ready framework, Wespath committed $750 million to two Transition Ready strategies (held in its P Series funds) benchmarked to the Russell 1000 Value Index and the MSCI World Ex US Index. While these are long-term investment strategies, we are pleased with their performance just three years out from inception.

Investment Performance2

Both the Russell 1000 Value Transition Ready (TR) Strategy and the MSCI World Ex US Index TR Strategy (P Series) have delivered competitive annualized returns since their inception:

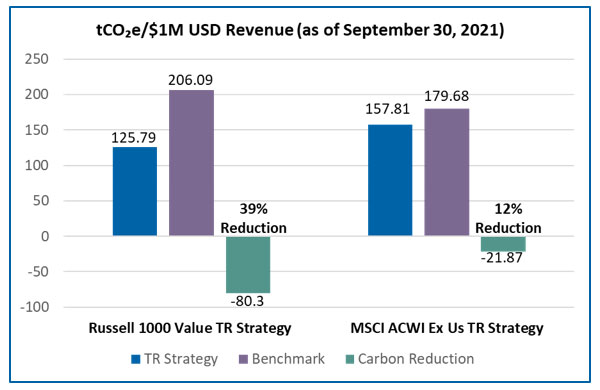

Environmental Performance3

In addition to exceeding their performance benchmarks, the Transition Ready strategies (P Series) have also achieved encouraging environmental results. For example, we can measure the relative carbon intensity of the Transition Ready strategies by comparing the strategies’ carbon footprint with that of the benchmark. Here is that measurement, using tonnes of carbon dioxide equivalent emissions (tCO₂e) per $1 million in revenue:

The initial success of the first two Transition Ready strategies justified additional allocations to strategies built around the Transition Ready framework. We have expanded the program to include enhanced passive strategies benchmarked to the Russell Top 200 Index and the MSCI World ex USA IMI Value Index.

As of September 30, 2021, Wespath and its subsidiaries invested over $2 billion in assets in Transition Ready strategies. We look forward to leveraging the Transition Ready framework across other passive strategies in our funds, as we continue to enhance our passive investments and strengthen our overall integration of low-carbon ready investment solutions.

1 Relative to the benchmark for the portfolio managed by the strategy.

2 This is not an offer to purchase securities. Historical returns are not indicative of future performance. The performance shown is gross of fees—that is, without the deduction of investment management fees, custody fees, and administrative and overhead expenses. The performance shown is for the stated time periods only. The Transition Ready strategies are not available for direct investment. Rather, they are held within investment funds made available by Wespath and its subsidiaries. The above performance reflects performance of Transition Ready strategies in applicable P Series funds. Not all investors are eligible to invest in the P Series funds. For more information about the P Series funds and eligibility to invest in the P Series, please refer to the Investment Funds Description – P Series.

3 Carbon emissions intensity calculated as tonnes of carbon dioxide equivalent emissions (tCO₂e) per $1 million in revenue generated by portfolio companies. Source: Wespath and ISS ESG, 2021.

What themes would you like us to cover in future blog posts? Let us know at [email protected]

To receive this chart each week via our Wespath Market Update e-mail, please contact our team at [email protected].

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.