By: Karen Manczko and the Wespath Team

As the year comes to a close, it’s natural to reflect on how quickly time seems to pass. The holidays, with all their sparkle and tradition, feel like a moment to pause and take stock—not just of our plans for celebrations, but of the time we’ve invested in what truly matters.

Warren Buffett once said, “Time is the only thing you can’t buy.” It’s a sentiment that resonates deeply, both in my personal life as my girls get older and closer to beginning their own adult lives and in my professional life with how we approach investments. Whether it’s in relationships, careers or financial goals, the decisions we make today lay the foundation for what we hope to achieve tomorrow.

This holiday season, we invite you to reflect on your own investments—of time, energy and intention. To help inspire your celebrations, we asked several Wespath colleagues to share their insights from this year. We hope their stories and sentiments encourage you to make the most of this special time with family and friends—and perhaps even inspire some new traditions to carry forward.

Evan Witkowski (Manager, Institutional Relationships): The in-between moments I get with my loved ones. If I chose a second, it’s coaching soccer on Wednesdays and Saturdays.

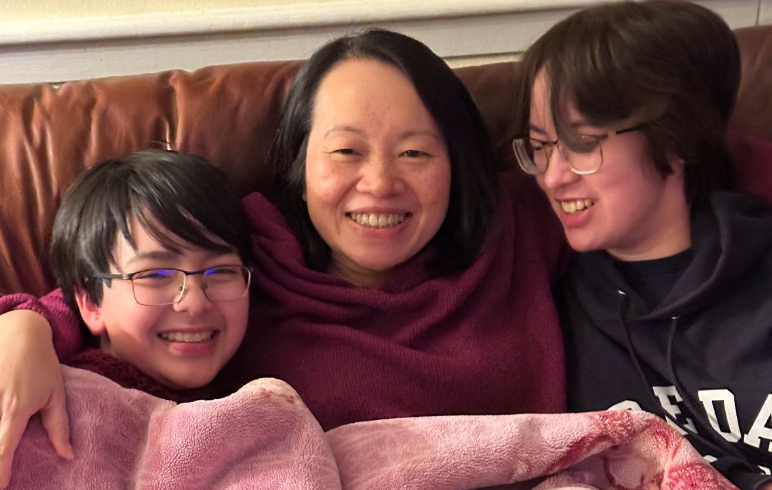

Hoa Quach (Director, Public Markets): Most days since my kids were very young, we watch Jeopardy after I get home from work and before dinner. It’s the one show that we all can sit through together. As my kids have gotten older (they’re teenagers now) they are able to answer more of the questions. It’s been great to see them be so proud of getting the questions right—and also a little sad that they know more than I do now.

Fred Huang (Senior Investment Analyst): I have a morning ritual where I make a cup of tea and then spend some time in silence thinking about the day ahead. It helps me mentally organize my day and get things done in an efficient and timely manner.

Trent Sparrow (Manager, Impact Investments): Walking my border collie, Dexter, brings me joy and centers my day.

Kate Tallo (Executive Assistant): Tending to my plants. It's my meditation!

Connie Christian (Manager, Fixed Income): My favorite book of 2024 was James by the incredibly talented writer Percival Everett. Everett reimagines Mark Twain’s The Adventures of Huckleberry Finn from Jim’s perspective, granting him agency and a voice that challenges stereotypes. The message, story, and prose are all well worth your time!

Kate Tallo: The most interesting thing I read this year was Island by Aldous Huxley. It was fascinating to hear how he explores the concept of humanity and some amount of inevitable suffering. However, Huxley also posits that two thirds of all suffering is “unnecessary.” This book allowed me to reexamine my own lens of the world and strive for joy and hope whenever possible.

Karen Manczko: Based on a recommendation from a Wespath partner (Clarence Trice from Methodist Foundation for Arkansas), I am currently reading Elon Musk’s biography by Walter Isaacson. It is a heavy read, but it has been one of the most interesting things I have read in a while. It dives into his childhood in South Africa, living in Canada, and his obsession with space and the letter X.

Joe Halwax (Managing Director, Institutional Investment Services): I am not necessarily looking forward to being an empty nester with my second child off to college in fall 2025. But all chapters of life come to an end, which means a new chapter is starting which will have new challenges and joys. I look forward to what this new chapter will bring with my wife, Jeannie. At a minimum, we will have more time to spend volunteering at the animal shelter.

Virgilio Calahong (Manager, Public Equities): Celebrating my 10th wedding anniversary with a trip to Switzerland with my wife. Neither of us have been to Europe before, and we’re excited to take in the scenery and sights.

Johara Farhadieh (Chief Investment Officer): In 2025, I’m excited about the opportunity to grow and expand our institutional investment business. Our focus will be on reaching new clients and deepening relationships with existing ones, all while continuing to deliver exceptional service and solutions tailored to meet our clients' needs. I’m particularly energized by the chance to innovate and bring fresh perspectives to how we serve our clients, ensuring we remain a trusted partner in achieving their goals. It’s an exciting time, and I look forward to the progress we’ll make together!

Fred Huang: Try to explore other people’s interests occasionally. It’s good to try to understand why people love to do what they do.

Trent Sparrow: Focus on the appreciative side of every issue instead of focusing on the depreciative side of things. We are hard wired to focusing on the depreciative side of things, so focusing on the appreciative side takes practice and work.

Sheri Young (Associate General Counsel): Believe in yourself. If cauliflower can become pizza, you can do anything.

Johara Farhadieh: The best piece of advice I heard this year was to prioritize self-care so that staff feels empowered to do the same. It’s a reminder that as leaders, we set the tone for workplace culture. By taking care of ourselves—whether that’s setting boundaries, taking breaks or managing stress—we signal to our teams that it’s not just acceptable but essential for them to do the same. When everyone prioritizes their well-being, it creates a healthier, more productive and more supportive environment for everyone.

Virgilio Calahong: I think the presidential election is the most interesting and consequential event for the markets this year. The candidates represented two very different schools of thought with respect to policy. Markets initially responded positively to Trump winning the election, but it remains to be seen how far this administration will go with its aims (particularly tariffs) and how markets will continue to react.

Evan Witkowski: Once again, we avoided a recession, despite the fact that nearly a third of economists (32%) predicted one for 2024. While this was down from 60% of economists predicting a recession in 2023, I am (pleasantly) surprised so many economists got it wrong. However, it will be interesting to see how this lack of a recession impacts economists’ predictions—and the accuracy of them—in the years to come.

Johara Farhadieh: The most interesting aspect of the markets this year has been the interplay of several key trends, each with its own far-reaching implications. First, the trajectory of interest rates continues to dominate market sentiment and behavior. With central banks maintaining a delicate balance between managing inflation and fostering economic growth, we’ve seen rates influencing everything from fixed-income markets to corporate capital allocation decisions.

I obviously also have to highlight that mega-cap companies have further solidified their dominance, particularly in the tech and AI sectors, driving market performance and creating a concentration of returns that raises important questions about diversification and valuations.

And on the other hand, the relative underperformance of small caps has presented potential opportunities for investors willing to take a contrarian stance. The disconnect between certain small-cap company valuations and underlying fundamentals could signify a compelling entry point for those with a longer investment horizon.

Finally, the lack of activity in mergers and acquisitions (M&A) has been impactful. Higher financing costs and increased regulatory scrutiny have created headwinds for deal-making. Hopefully, this lull allows for a rebound once conditions stabilize in the near future. The lack of M&A has also underscored a shift in corporate strategies, with companies focusing on organic growth and internal innovation over large-scale acquisitions.

These trends together paint a picture of a complex, evolving market environment where challenges and opportunities are tightly interwoven. Hopefully, this will create more opportunities than challenges in 2025!

Much like our portfolios, the memories and traditions we build during the holidays are a testament to long-term value. A child waking up every morning in December moving their advent calendar just one day closer to the 25th showcases the patience it takes to see returns grow over time in hopes of reaching a certain date or goal. And for parents and grandparents, looking back at a life filled with rich experiences is a reminder that time, thoughtfully spent, yields immeasurable rewards. From all of us at Wespath, we wish you a joyous holiday season filled with peace, happiness and meaningful moments.

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.