By Joe Halwax, CAIA, CIMA

Managing Director, Institutional Investment Services

By Raj Khan, CFA

Director, Investment Research

August 16, 2024

In recent weeks we have watched as heightened volatility in Japanese equities spilled over to global stock markets, including here in the U.S. This volatility has been associated with an unwinding of the “yen carry trade.” Naturally, many investors have asked: What is the yen carry trade? And, more importantly, how does it impact a long-term U.S.-based investor like Wespath?

What Is a Carry Trade?

To start, we need to define the term “carry.” For investors, carry is most often discussed in currencies, borrowing money in one form of currency with a low interest rate and investing in an asset or currency with a higher interest rate. The difference in the interest rates represents the carry, or the rate of return the investor hopes to achieve.

Here’s an example: Let’s say an investor borrows money in Japanese yen at a 2% interest rate. They then purchase an asset denominated in U.S. dollars (USD) that offers a 5% return. The carry would be the difference between the 5% and 2%, which equates to a 3% carry return.

Unwinding a carry trade refers to the reversal of these trades. This can happen when the carry (or the difference between the two rates) begins to dwindle. For instance, in the example above, if yen interest rates begin to increase, the investor who engaged in the carry trade may decide to exit their positions to avoid losses. That investor may also exit their positions if the expected return on the USD-denominated asset decreases. In either case, the carry would be reduced.

The currency exchange rate also plays a crucial role in the profitability and risk associated with a carry trade. For example, if the Japanese yen appreciates relative to USD, the cost of repaying what the investor originally borrowed increases. This can erase the profits made from the interest rate differential—or even lead to losses. This is usually another factor that leads to investors unwinding their carry trades.

When a large number of investors unwind their carry trades, it usually leads to two outcomes:

The Yen Carry Trade of 2024

The example used above is exactly what transpired in late July and early August of this year. The yen is frequently used in carry trades because it is a highly liquid currency, making it an attractive option for investors looking to borrow. Additionally, Japan has maintained some of the lowest interest rates among developed countries for decades, meaning it was relatively inexpensive to borrow yen—leading to more carry trade opportunities.

This changed in late July, when the Bank of Japan (BoJ) hiked rates by 25 basis points (bps), which was 10 bps higher than expected. The yen rallied sharply on this news. Together, the increase in Japanese interest rates and a suddenly stronger yen triggered a wave of volatility in yen carry trades.

As the yen appreciated, investors who had borrowed in yen found it more expensive to repay their loans. This led to margin calls. A margin call is a risk associated with margin trading, or investing with borrowed money. They happen when a trade’s value falls below a certain required level, forcing the investor to add more funds or sell assets to cover their losses.

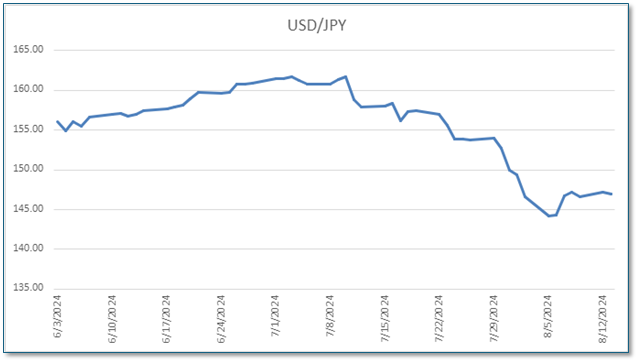

As the yen appreciated, investors who had borrowed in yen found it more expensive to repay their loans. Margin calls further exacerbated the volatility, leading to a rapid unwinding of yen carry trades. Japanese yen dropped quickly from above 160 USD to below 145 USD from July 11 to August 11:

(Source: FactSet)

The unwinding process led to significant selloffs in global equity markets, including in Japan. The Nikkei index—which measures the performance of 225 major Japanese companies—fell 12.4% on August 4, causing a ripple effect in global markets. The S&P 500 subsequently dropped 3%, its worst one-day loss in nearly two years.

However, the following day the Nikkei rallied 10%. The BoJ downplayed the probability of further interest rate hikes, which helped quell some investor fears. The U.S. markets have also since erased much of their early August losses, suggesting that this carry trade unwind is more of an anomaly than something more systemic and widespread.

That said, it is hard to assess whether the “unwinding” of carry trades is fully complete. One report by JP Morgan on August 9 estimated that about 50% of the carry trade was unwound (using data about speculative short positions in yen) . Since that report, the short positions have decreased further, suggesting the unwind is even closer to complete.

What Does It Mean for Wespath’s Investors?

Wespath’s funds are not immune to market events like the unwinding of yen carry trades; however, the funds were constructed to weather short-term market oscillations from exactly these types of events.

For example, our International Equity Fund – I Series (IEF-I) does have exposure to Japanese markets. However, our active asset managers within IEF-I held less exposure to Japanese equities than the fund benchmark. The sharp Nikkei sell-off actually led to positive relative performance for IEF-I compared to the fund benchmark. Furthermore, the fund’s diversifying investments in other parts of the benchmark, including emerging markets, saw additional active management gains that drowned the impact from the yen carry trade unwinding event.

As long-term investors, we and our asset managers are constantly faced with events like carry trade unwinds, sharp market moves triggered by economic reports or earnings announcements from stocks in the “Magnificent 7” group. At times, these events will be a signal of a much larger concern, such as when Lehman Brothers failed in the fall of 2008. However, the vast majority of events, such as the yen carry trade unwinding, are mostly noise that we filter out over the long-term, with our asset managers using any dislocations to tactically buy assets at cheaper prices.

Wespath follows a disciplined process for investing and believes in looking at the long-term over short-term tactical trading. While market fluctuations can be unsettling, corrections are a natural part of investing and can be triggered by a number of events.

1Historical returns are not indicative of future performance. The IEF-I performance benchmark is MSCI ACWI ex-USA IMI. The investments of the funds may vary substantially from those in the applicable benchmark. The benchmarks are based on broad-based securities market indices, which are unmanaged, cannot be invested in and are not subject to fees and expenses typically associated with investment funds. Investments cannot be made directly in an index. Please refer to the Investment Funds Description – I Series for more information. Wespath investment funds are neither insured nor guaranteed by the government.

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.